These are the current Frequently Asked Questions from our clients. As we progress through the tax season and collect more questions, we'll add to this list.

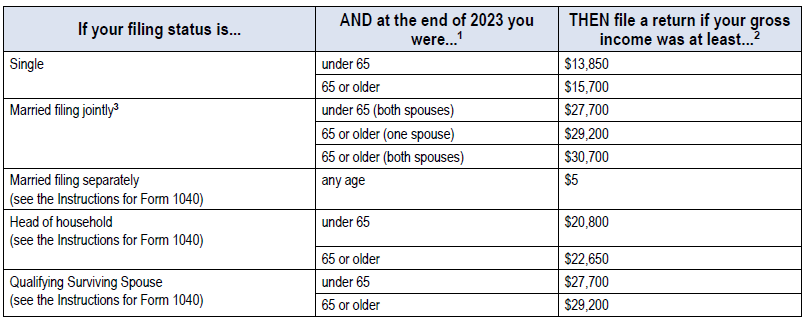

Generally, if your income is above the amount shown in the chart below for your filing status, you are required to file a tax return. Do not include Social Security benefits unless one-half of your Social Security benefits plus your other gross income and any tax-exempt interest is more than $25,000 ($32,000 if married filing jointly).

There are other situations where you must file. If you are a dependent and your income is above a certain level, if you received distributions from a Health Savings Account (Form 1099-SA), if you have self-employment earnings over $400, if you received advance payments of the Premium Tax Credit for Covered California health insurance (Form 1095-A), or if you sold a home and received Form 1099-S for the sale, you must file a tax return.

You should file a tax return to recover any excess withholding, if you qualify for the Earned Income Credit, Additional Child Tax Credit, or American Opportunity Credit. You should also file if you qualify for a California state tax credit or want to prevent tax identity theft.

If you have questions about your specific situation, you can use the Interactive Tax Assistant at IRS.gov to determine if you need to file a tax return.

California has separate filing requirements. If you are a California resident, the California filing requirements are listed on this page of the Franchise Tax Board website.

Your Federal and California tax returns must be e-filed by April 15, 2026. If you are filing a paper tax return by mail, the return must be postmarked by April 15, 2026.

You can file for and obtain an automatic extension of time to file your individual tax return by submitting IRS Form 4868, Application for Automatic Extension of time to File U.S. Individual Income Tax Return. This is not an extension of time to pay, it is only an extension of time to file. If taxes are due you will be assessed penalties and interest on the amount due if payment is not received by April 15, 2026.

If you don't owe any taxes you do not need to file an extension. There is no penalty for not filing if you don't owe any tax. If you are due a refund you do not need to file an extension. The IRS is happy to keep your money (without paying you interest) until you file a return to claim your refund.

You can also get an extension by electronically paying all or part of your estimated income tax due and indicating the payment is for an extension. Go to the Extension of Time To File Your Tax Return page at IRS.gov for more information on filing for an extension, including ways to complete an online request for extension.

In California, no application is required for an extension to file. However, the same rules apply if taxes are due. The amount you owe must be paid by April 15, 2026 to avoid penalties and interest. You can make a payment for an automatic extension by filing FTB Form 3519, Payment for Automatic Extension for Individuals. This form must be submitted with payment by April 15, 2026. Visit the Extension To File page at the California Franchise Tax Board website for more information about California extensions.

Up to 85% of your Social Security benefits may be taxable depending upon your income and filing status. The taxable amount is based on combined income. Combined income is calculated as your Adjusted Gross Income (AGI) plus any nontaxable interest plus one-half of your Social Security benefits. If you:

- file a federal tax return with filing status single and your combined income is

- less than $25,000 your benefits are not taxed.

- between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

- more than $34,000, up to 85 percent of your benefits may be taxable.

- file a joint return, and you and your spouse have a combined income that is

- less than $32,000 your benefits are not taxed.

- between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits.

- more than $44,000, up to 85 percent of your benefits may be taxable.

- are married and file a separate tax return (married filing separate), you will probably pay taxes on 85 percent your benefits regardless of combined income.

Each January, you will receive a Social Security Benefit Statement (Form SSA-1099) showing the amount of benefits you received in the previous year. The information on Form SSA-1099 is needed to complete your tax return and is used to calculate how much (or if any) of your Social Security benefits are subject to tax.

Social Security benefits are exempt from California state income tax.

Here are the Standard Deductions for the various filing statuses for tax year 2025:

| Filing Status | Standard Deduction | Additional Deduction |

|---|---|---|

| Single | $15,750 | Add $2,000 for over 65 or blind. Add $4,000 if over 65 and blind. |

| Married Filing Separately (MFS) | $15,750 | Add $1,600 per person for over 65 or blind. Add $3,200 for each person over 65 and blind. |

| Married Filing Jointly (MFJ) | $31,500 | Add $1,600 per person for over 65 or blind. Add $3,200 for each person over 65 and blind |

| Qualified Surviving Spouse (QSS) with dependent child | $31,500 | Add $1,600 for over 65 or blind. Add $3,200 if over 65 and blind. |

| Head of Household (HoH) | $23,625 | Add $2,000 for over 65 or blind. Add $4,000 if over 65 and blind. |

For tax year 2025 an additional deduction of $6,000 for taxpayers Age 65 or older is allowed. The deduction starts phasing out when Modified Adjusted Gross Income (MAGI) exceeds $75,000 ($150,000 MFJ). Taxpayer (and spouse if MFJ) must provide a valid Social Security Number (SSN) on the tax return. This deduction is not available to those filing MFS or those with only an ITIN.

Use our Itemized Deduction Worksheet to identify and organize your deductions.

If you use the Standard Deduction on your Federal tax return, you may benefit from itemizing on your California income tax return. The California Standard Deduction is $5,706 for Single or MFS, and $11,412 for all other filing statuses. Remember that state income tax and sales tax is not deductible from your state income tax. We will look at your deductions and choose the most beneficial deduction for you.

If you have no Federal tax liability using the Standard Deduction, there is no point in itemizing. Similarly, if you have no California state tax liability using the California Standard Deduction, there is no benefit in itemizing for state.

The Earned Income Tax Credit (EITC) is a refundable credit paid to taxpayers who meet certain income and filing status qualifications. The amount of the credit varies by your income and the number of dependents claimed on the tax return. A refundable credit is paid even if you owe no taxes. In order to qualify for EITC, you must be at least 25 but less than 65 years old and must have earned income, wages or self-employment income, not greater than the amounts shown in the following table.

| Dependents | Single, Head of Household, or Qualifying Surviving Spouse |

Married Filing Jointly |

|---|---|---|

| 0 | $19,104 | $26,214 |

| 1 | $50,434 | $57,554 |

| 2 | $57,310 | $64,430 |

| 3 or more | $61,555 | $68,675 |

Those with investment income greater than $11,600 or those married filing separately do not qualify for Federal EITC.

Maximum credit amounts are:

- No qualifying dependents: $649

- 1 qualifying dependent: $4,328

- 2 qualifying dependents: $7,152

- 3 or more qualifying dependents: $8,046

Taxpayers may also qualify for the California Earned Income Tax Credit (CalEITC). Unlike the Federal EITC, there are no age limitations for CalEITC. Details for the CalEITC can be found on the California Earned Income Tax Credit page at the FTB website.

Providing electronic payment information is voluntary. If taxpayers do not provide this information and no exception applies, their refunds could take longer to process. Taxpayers should provide direct deposit information when filing a tax return. If banking information is missing when filing a tax return, the tax return will still be accepted and processed. However, when filing electronically, the taxpayer may receive an alert notifying them of the missing banking information and outlining the next steps if they are due a refund.

For all taxpayers with missing information, the IRS will send letters to individuals using their last-known address on record, asking them to update their banking information if they did not provide it on their tax return, or if their financial institution rejected the direct deposit. The taxpayer will then receive a CP53E notice in the mail requesting a response within 30 days, either to provide banking information or to explain why such information cannot be provided. Additionally, the Where’s My Refund? tool on IRS.gov will provide messaging related to the need for banking information. The taxpayer will be able to use the IRS Individual Online Account to provide this information. For security reasons, IRS employees cannot take direct deposit information over the phone or in person. Once the taxpayer provides the direct deposit information or exception, the refund will be immediately released via direct deposit or paper check. If there is no response to the notice and there are no other issues with the tax return, the refund will be released as a paper check after six weeks.

Source: IRS Fact Sheet 2026-02

If you have a Venmo, Cash App, or PayPal account, you can have your refund sent directly to your mobile app. See this guide to see how to find your routing number and account number for direct deposit of your refund to your mobile app.

An Identity Protection Personal Identification Number (IP PIN) is issued to anyone who has notified the IRS that they are or suspect they are a victim of identity theft. If you are a confirmed victim of tax-related identity theft and the IRS has resolved your tax account issues, the IRS will mail you a CP01A Notice with your new IP PIN each year. You must provide your current PIN number in order to e-file or paper file your tax return. The IRS will reject your tax return if you have been issued an IP PIN and it is not entered on your tax return. Every person who receives an IP PIN must enter it on the return. This includes the primary taxpayer, spouse, and dependents. Note that not all persons listed on the return may have been issued an IP PIN.

You can voluntarily apply for an IP PIN even if you have not been impacted by identity theft. A voluntary IP PIN is valid for one calendar year and is not automatically renewed. However, like the IP PIN issued to victims of identity theft, once an IP PIN has been assigned, it must be entered on your tax return.

You can read more about the IP PIN program, including how to apply for or recover an IP PIN on the Get An Identity Protection PIN (IP PIN) page at IRS.gov.

If you are not required to file a tax return, an IP PIN is an excellent way to protect yourself from tax-related identity theft. You can apply for an IP PIN and just not file a tax return. Any potential thief who attempts to use your Social Security Number to file a false tax return would also have to know your IP PIN.

We encourage everyone to set up accounts on the IRS, Franchise Tax Board (FTB), and Social Security Administration websites. All of these agencies have personalized resources that let you check the status of your income tax and Social Security benefits.

You can create your own IRS account at:

https://www.irs.gov/payments/your-online-account

Click on the blue

"Sign in to your Online Account" button in the middle of the page and,

if you don't already have an account, you can create a new account using

ID.me. ID.me is the IRS's identity verification agent. You will be asked

to upload identity documents or meet in a video chat with an ID.me identity

verification agent. Once you have established your account, you'll be able

to see your tax account balance, make a payment, view your tax records, and

download transcripts of previous year tax returns.

The California Franchise Tax Board offers a MyFTB Account. Go to:

https://www.ftb.ca.gov/myftb

to login or create an account.

Similar to the IRS website, you can view your current California tax return

status, see your tax account balance, view a past return, or make a WebPay payment.

However, your myFTB account also allows you to file your own California tax

return, estimate your California taxes, message the FTB, or chat with an

FTB agent. There are many other services offered, so if you need to keep an

eye on your California taxes, you should set up your own myFTB account.

You can also create an account on the Social Security website at:

https://www.ssa.gov/myaccount

The my Social Security account will allow you to set up or change your

direct deposit account, get your SSA-1099 Social Security Benefit Statement

for your tax return, get personalized benefit estimates, request replacement

Social Security cards, and more.

These three free resources can really help you manage your taxes and Social Security benefits to put you in control of your finances.

The IRS offers several individual payment plans that will allow you to pay off

your balance over time. Plan qualifications and fees are described on the

IRS website at:

https://www.irs.gov/payments/your-online-account

You can read about the various plans and choose the plan that works for you.

The California Franchise Tax Board website contains information on how

to pay your California income taxes using direct debit from your bank

account, a major credit card, or you can set up a payment plan. Unlike the

IRS, the FTB charges a minimum fee to establish a payment plan, but once

your payment plan is approved, you can avoid future penalties and interest by

making timely payments according to the payment plan.

Go to:

https://www.ftb.ca.gov/pay

for more information on FTB payment methods and plans.

No, you're not in trouble. In order to combat the increase in identity theft, both the IRS and FTB have stepped up their random identity verification programs. If you receive a legitimate letter from the FTB or the IRS asking for copies of your driver's license and tax forms, please make the copies as requested and send them to the address listed in the letter.

If you need assistance with an IRS or FTB letter, bring it to any El Dorado Countty VITA or AARP Tax-Aide site during normal operating hours and we'll take a look at it. No appointment necessary.

Maybe. New electric vehicles purchased prior to September 30, 2025 may qualify for a nonrefundable credit of up to $7,500. Purchasers of a used EV may qualify for a nonrefundable credit up to $4,000 if the purchase was made before September 30, 2025. A nonrefundable credit means that the credit will lower the amount of taxes due thereby increasing your refund, but it won't add to your refund above the amount of taxes due. You can see if the vehicle qualifies for the credit and the exact amount of your credit by going to the EPA's fueleconomy.gov website and using the new or pre-owned tax credit calculators. You'll need to know the year, make, and model of the vehicle. For a new car, you'll need the vehicle delivery date. For a used EV, you'll need to know the price you paid for the car.

The credit for new EV's is based on certain manufacturing, price, and battery capacity qualifications. Used vehicles must be at least two years older than 2024 and priced under $25,000.

To claim the credit, your modified adjusted gross income (MAGI) must not exceed $300,000 for married couples filing jointly, $225,000 for heads of households, or $150,000 for all other filers. The credit is claimed on Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit. The Clean Vehicle Tax Credits webpage at IRS.gov provides additional details about the available tax credits.

Unfortunately, Form 8936 is out-of-scope for all VITA/TCE tax preparation sites, so you'll have to see a paid preparer or do your own taxes to claim this credit. Use the IRS tax credit calculator to see if the amount of credit is worth paying for a professional tax preparer.

Yes, a new energy-efficient biomass (pellet) stove qualifies for a tax credit. The Inflation Reduction Act of 2022 makes several clean energy tax credits available to individuals. New and used clean vehicles were covered in the previous FAQ, but you can also receive a tax credit for making energy efficient home improvements.

The Energy Efficient Home Improvement Credit provides a tax credit of 30% of the cost for heating and cooling equipment, windows, doors, heat pumps, insulation and air sealing materials that meet energy efficiency standards. You can also receive a tax credit of up to $150 for a home energy audit. The Energy Efficient Home Improvement Credit is in scope for all VITA/TCE sites and we can claim this credit for you when we prepare your tax return. Labor costs can only be applied to some of the improvements, so bring in your invoice when we do your taxes so we can calculate the correct amount of your credit.

The Residential Clean Energy Credit provides a tax credit for the purchase of solar, wind, or geothermal power generation systems, solar water heaters, fuel cells, or battery storage. The Residential Clean Energy Credit is out-of-scope for VITA/TCE, so you'll have to see a paid preparer or do your own taxes to claim this credit.

IRS Publication 5886-A provides a summary of the clean energy tax credits available. Detailed information is available at the IRS Home energy tax credits webpage. You'll see the term “biomass stoves and boilers” used in the reference material. Biomass is a blanket term for fuel derived from agricultural crops, wood and wood waste, and other natural material. Biomass includes wood-burning and pellet stoves and boilers.

Both the Energy Efficient Home Improvement Credit and Residential Clean Energy Credit expire on December 31, 2025, so these credits will not be available after this tax year.

If you have a computer with Internet access, the IRS provides several resources to help taxpayers prepare and e-file their own tax return. If your Adjusted Gross Income (AGI) is $79,000 or less, you can choose from eight guided software packages at IRS Free File. Be sure to check out all offers from the eight providers. Some offer state tax preparation and one package provides support for Spanish-speakers. This video provides a quick introduction to the IRS Free File program.

If your income is above the $79,000 threshold, you can use the IRS Free File Fillable Forms (FFFF) service. Free File Fillable Forms are electronic versions of IRS paper forms, so you have to be familiar with what goes where on each form. If you can manage that, the FFFF service allows you to electronically sign and file your return and print a copy for your records.

If you want to file on your own but may need help, you can use the United Way MyFreeTaxes program to file your own tax return. MyFreeTaxes allows you to use the same TaxSlayer software we use at our VITA/TCE sites plus you can get help from the MyFreeTaxes Helpline with trained VITA volunteers to help you complete your tax return. Income restrictions apply when filing with virtual or in-person help.

If you prepare and file your own tax return, do not also make an appointment at an El Dorado County Free Tax Prep site to do your return. If your tax return has already been filed, your second return will be rejected when we try to file it a second time.

There are various types of tax return preparers, including certified public accountants, enrolled agents, attorneys, and many others who don't have a professional credential. You expect your preparer to be skilled in tax preparation and to accurately file your income tax return. You trust him or her with your most personal information. They know about your marriage, your income, your children and your social security numbers – the details of your financial life. Most tax return preparers provide outstanding and professional tax service. However, each year, some taxpayers are hurt financially because they choose the wrong tax return preparer.

The IRS offers tips on how to find a tax preparer in the IRS Tax Tips section at IRS.gov. The Tax Tip covers various topics such as qualifications, costs, and tips for assisting the preparer with the preparation of your return. Many of these tips are covered in this IRS video.

The IRS Tips page mentioned several different types of tax preparers, Enrolled Agents (EAs), Certified Public Accountants (CPAs) and tax law attorneys. You can use the IRS Directory of Federal Tax Return Preparers with Credentials and Select Qualifications to locate tax professionals in your area who have registered with the IRS. This tool will help you find a tax return preparer with specific qualifications to meet your particluar tax preparation needs.